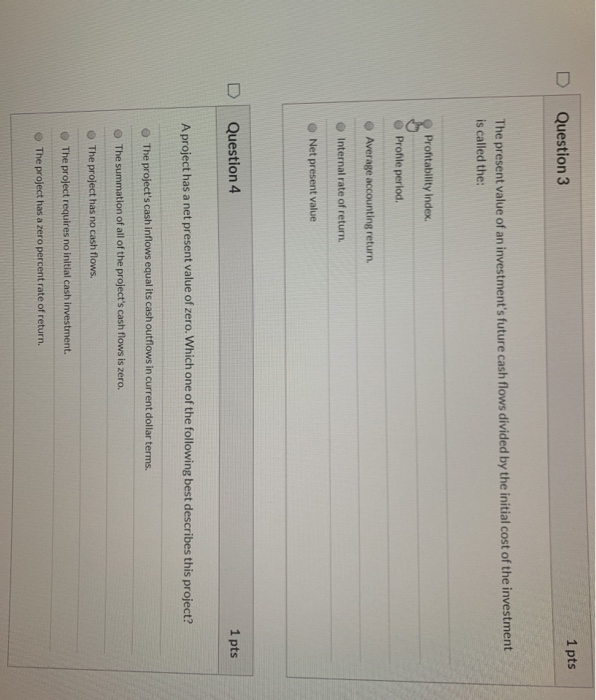

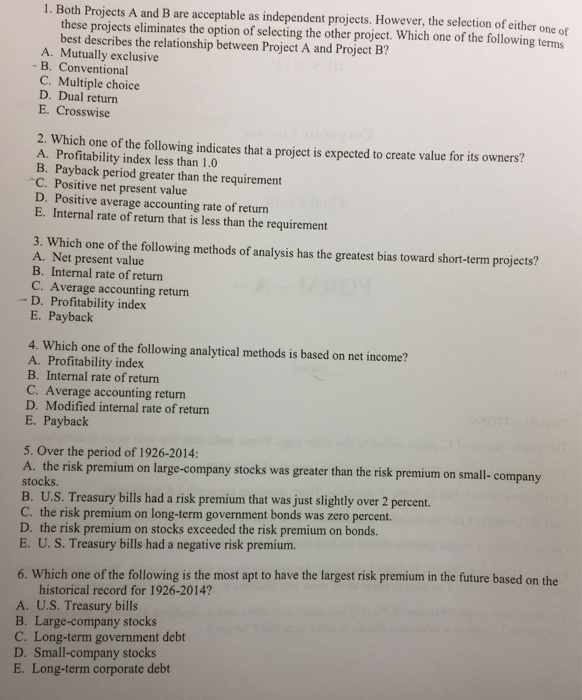

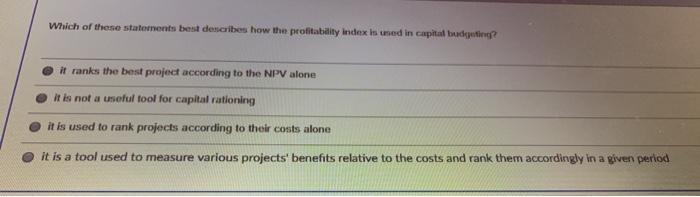

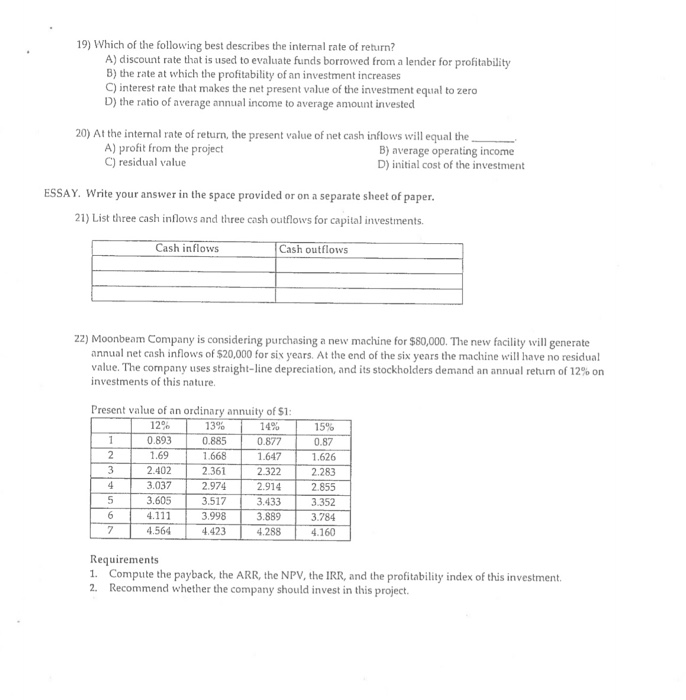

Which Of The Following Best Describes The Profitability Index?

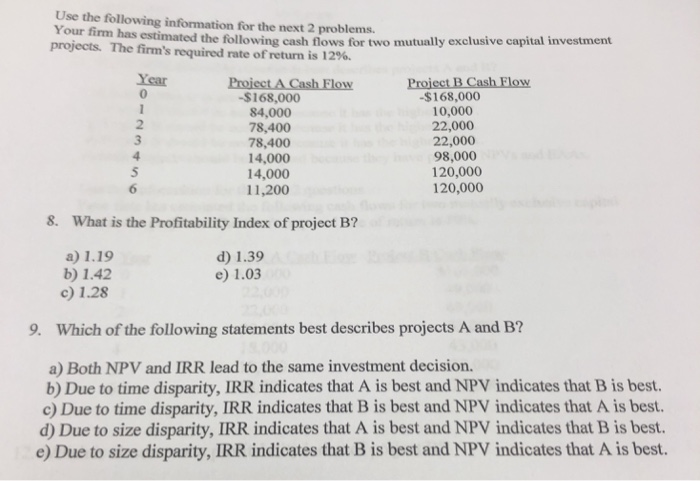

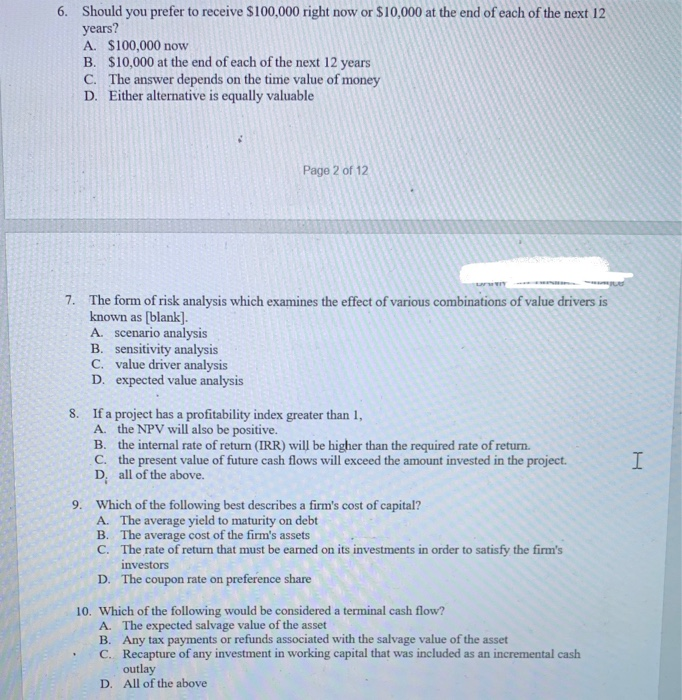

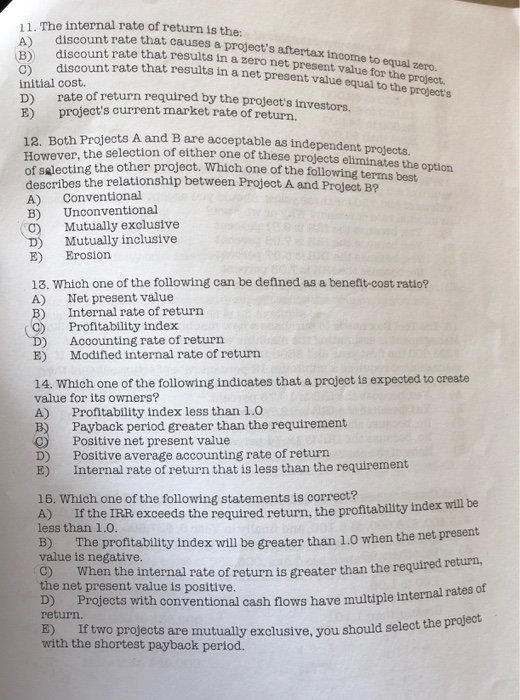

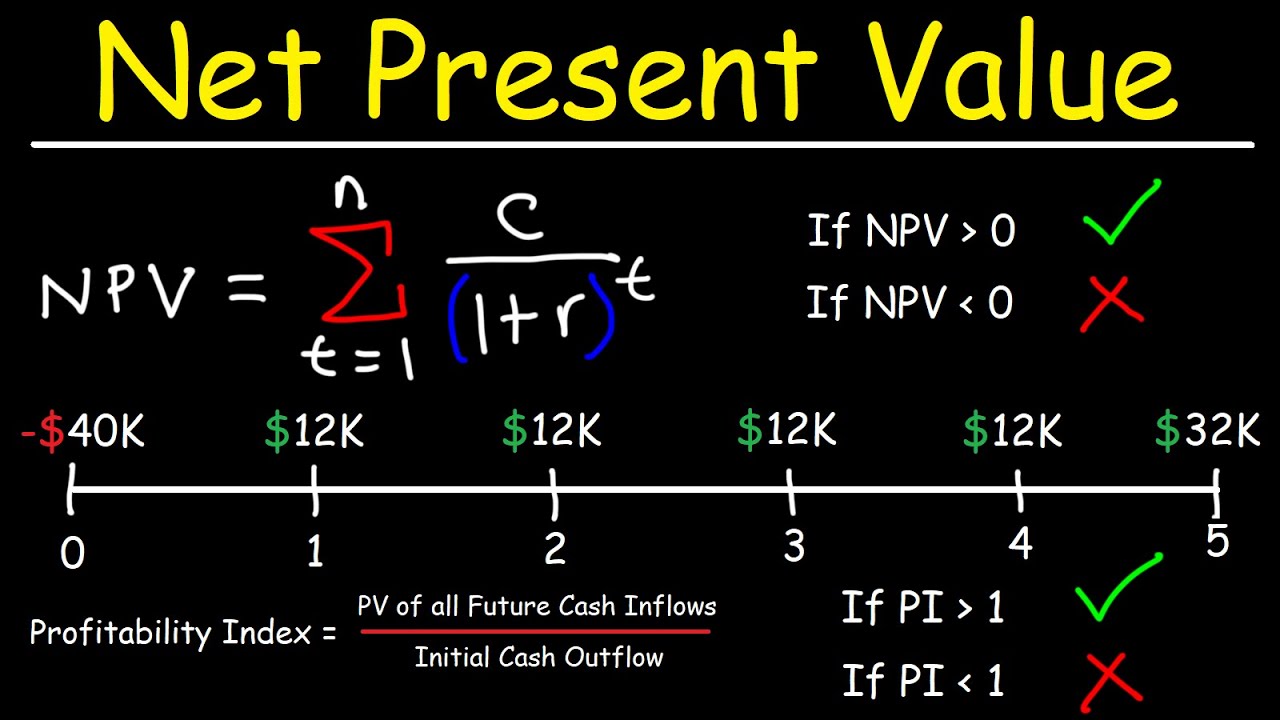

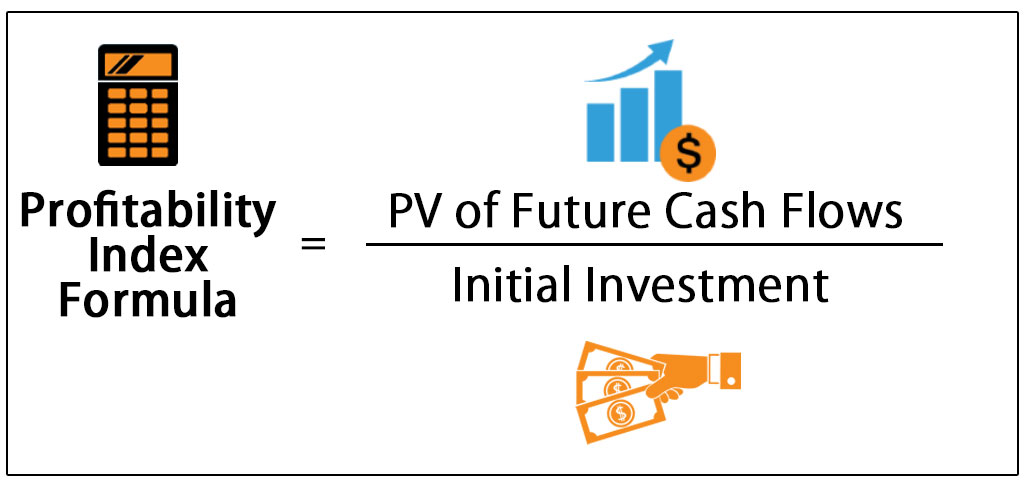

Which of the following best describes the profitability index?. A an index of projects based on their net income B the ratio of present value of net cash inflows to initial investment C the ratio of total cash inflows to initial investment. An array of possible investment outcomes at different discount rates 6 Which of the following is true of discounted cash flow methods like NPV and IRR. The PI is calculated by dividing the present value of future expected cash flows by the initial investment.

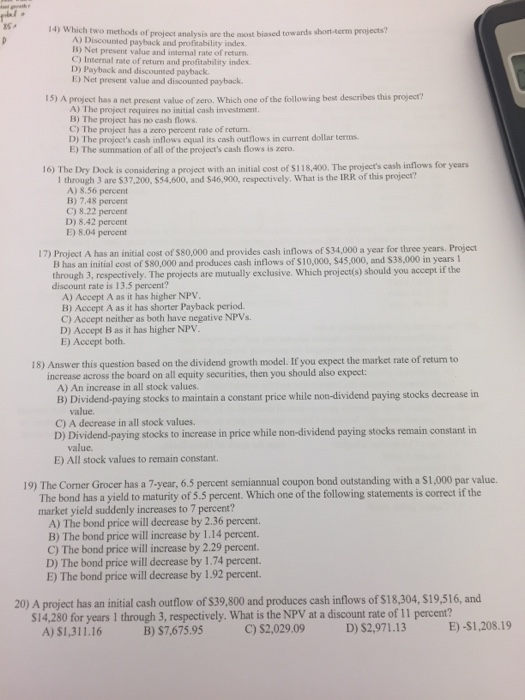

A choose D because it has a higher profitability index. B choose D because it has a lower profitability index. A limited amount of capital is available to the company due to external factors such as banks unwillingness to lend.

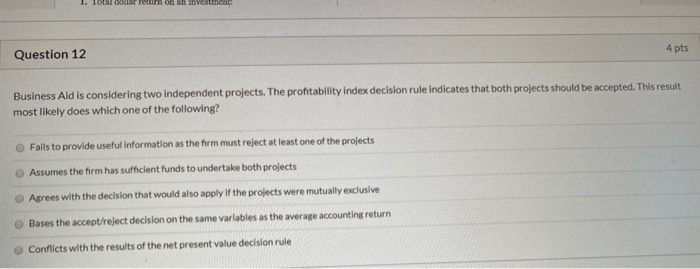

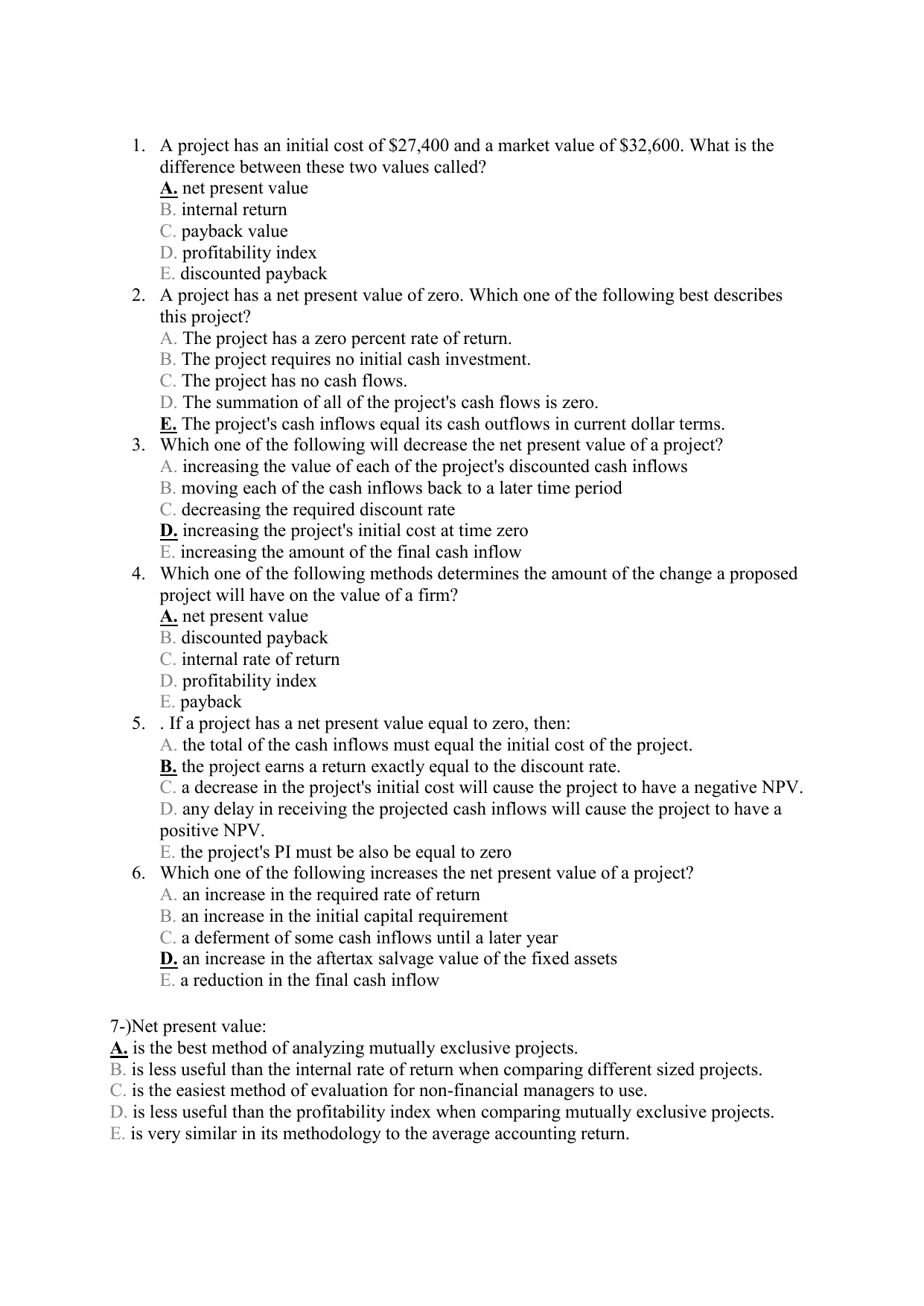

Take any investment opportunity where the net present value is not negative turn down any opportunity when it is negative. Which of the following decision rules might best be used as. The following details are provided by Dopier Company.

An investment has conventional cash flows and a profitability index of 10. An array of possible investment outcomes at different discount rates Answer is C 6 Which of the following is true of discounted cash flow methods. D 5 Which of the following decision rules is best defined as the amount of time it takes to pay back the initial investment.

The index itself is a calculation of. An index of projects based on their net income B. The ratio of present value of net cash inflows to initial investment D.

Which of the following BEST describes why Larry came to this. Which of the following best describes the NPV rule. 3 Which of the following best describes a firmʹs cost of capital.

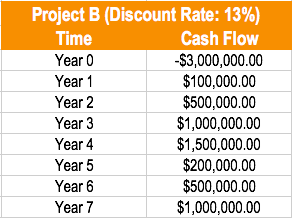

C 214-38 Which of the following best describes the profitability index. Which project has the highest profitability index.

The ratio of total cash inflows to initial investment C.

Profitability ratios indicate how efficiently a company. 5 Which of the following best describes the profitability index. Which of the following statements is correct regarding the internal rate of return IRR method. Setting the budgets of an investment analyzing the effect of an investment on workers morale evaluating different investment. Which of the following BEST describes why Larry came to this. Given this which one of the following must be true. The PI is calculated by dividing the present value of future expected cash flows by the initial investment. A limited amount of capital is available to the company due to internal factors such as management unwillingness to take more risk. A internal rate of return IRR B profitability index C net present value NPV D payback period Answer.

The PI is calculated by dividing the present value of future expected cash flows by the initial investment. Take any investment opportunity where the net present value is not negative turn down any opportunity when it is negative. C choose W because it has a lower profitability index. 3 Which of the following best describes a firmʹs cost of capital. Profitability ratios assess a companys ability to earn profits from its sales or operations balance sheet assets or shareholders equity. Which of the following statements is correct regarding the internal rate of return IRR method. D choose W because it has a higher profitability index.

:max_bytes(150000):strip_icc()/dotdash_final_Profitability_Index_Oct_2020-011-3cc06137c4e24b7dbef3515c7d989bd3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

/dotdash_Final_An_Introduction_to_Capital_Budgeting_Sep_2020-01-e2feb6a3d3a74e3abd4d2da585c9ef20.jpg)

:max_bytes(150000):strip_icc()/investment-safe-money-insurance-protection-growth-1576177-pxhere.com-c7addfcd81d54597bbecf47937ff2327.jpg)

Post a Comment for "Which Of The Following Best Describes The Profitability Index?"